Ridgefield Energy leases and acquires mineral interests, working interests and royalty interests through a highly-targeted approach.

Our title expertise and experience, paired with our geographic focus, set us apart and result in an efficient and effective experience with interest owners.

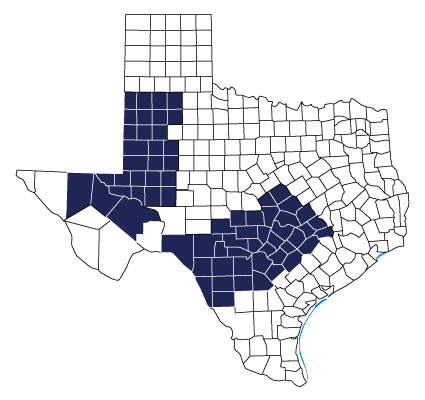

Ridgefield has acquired interests from more than a thousand sellers to date across the Eagle Ford Shale and Permian Basin since 2011.